What to watch for

After completing this lesson, you’ll be able to:

- Describe what makes a business a start-up

- Define key terms related to start-ups

Welcome to our third and final case study for the semester. We’re going to spend a bit of time talking about start-ups. If you’ve ever watched Shark Tank and felt a bit confused by some of the business jargon that gets thrown around, this is the lesson for you.

Why are we talking about start-ups? A few reasons, actually. First, “I’m doing a start-up” is kind of the new “I’m in a band.” Because of the widespread popularity of technology and the outsized financial rewards earned by the tiny sliver of start-ups that make it big, start-ups are actually kind of in right now (albeit still in a nerdy way ?).

More importantly, a lot of our favorite technology and new media comes from companies that began their lives as start-ups, and it’s important to understand how the stuff we use gets made.

Finally, we’re going to spend a good chunk of this time talking about the business side of start-ups. While this isn’t a business course, it’s important to take a bit of time to understand the economics of how these businesses work. For startups 1, making money matters because money means they can make stuff.

Required readings:

? “Startup company“, Wikipedia

(2,971 words / 15-19 minutes)

- This quote from Paul Graham is essential: “A startup is a company designed to grow fast. Being newly founded does not in itself make a company a startup. Nor is it necessary for a startup to work on technology, or take venture funding, or have some sort of “exit”. The only essential thing is growth. Everything else we associate with startups follows from growth.”

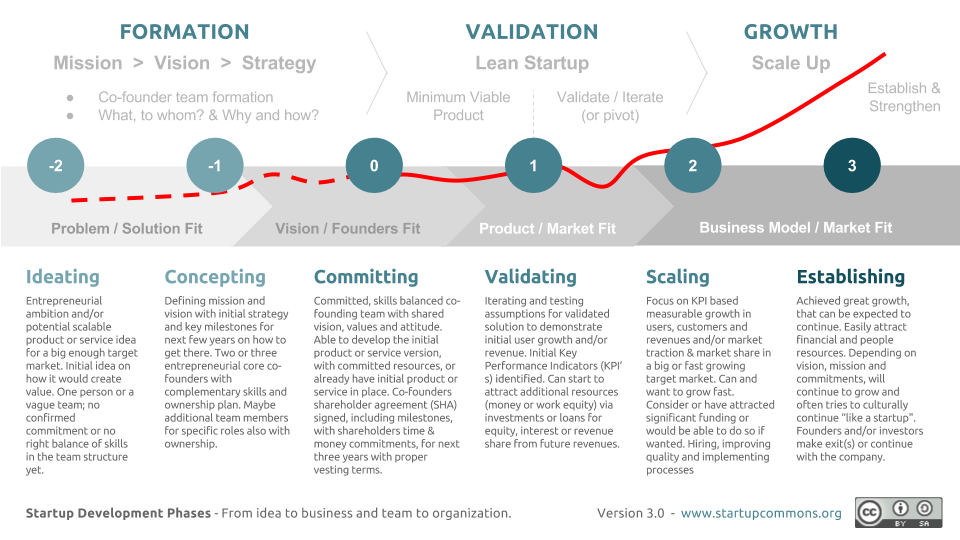

- This chart is pretty handy:

- Be sure to understand what an IPO is.

- Chase down at least the basic definitions for all the links in the following: “Startups encounter several unique options for funding. Venture capital firms and angel investors may help startup companies begin operations, exchanging seed money for an equity stake. In practice though, many startups are initially funded by the founders themselves. This is known as Bootstrapping. Factoring is another option, though not unique to startups. Other funding opportunities include various forms of crowdfunding, for example equity crowdfunding.”

? “Why the Lean Start-Up Changes Everything” by Steve Blank

(3,066 words / 16-20 minutes)

This article is at the heart of much of the modern startup movement—Steve Blank, the author of this article, literally wrote the book on how to build a startup! Read the whole thing carefully, but here are a few key quotes:

- “Business plans rarely survive first contact with customers.”

- “No one besides venture capitalists and the late Soviet Union requires five year plans to forecast complete unknowns.”

- “Startups are not smaller versions of larger companies.”

- “Existing companies execute a business model while start-ups look for one.”

- “A business model canvas is how start-up founders summarize their hypotheses.”

- “Lean start-ups use a “get out of the building” approach called customer discovery to test their hypotheses.”

- “Agile development is the process through which startups create minimum viable products.”

Again, let me reiterate that you’ll need to read the whole article to fully grasp the ideas presented in those quotes.

? “40+ Startup Jargon Words You Need To Know To Raise Money” by Kate Harrison

(1,791 words / 9-11 minutes)

Learning the lingo of a thing is always essential—it helps you become an informed participant in the conversation. Read through all the terms in the article (and further research any you find interesting!), but these are the ones I’d focus on:

- Accredited Investor – A rich individual potentially interested in investing in your company. For your start-up, you must require potential investors to prove that they can afford to risk their money in your start-up, in order to comply with the law.

- B-to-B – Business to Business. Your company sells things to other companies.

- B-to-C – Business to Consumer. Your company sells stuff to the masses.

- Burn Rate (aka Run Rate) – How fast you are blowing through your cash. It’s not unusual for a start-up to lose large sums of money for several years before breaking even, or — please oh please — making a profit. (See runway below).

- Churn Rate – Customers lost subsequent to acquisition in a subscription-based business model. Because of the churn rate, your growth might not look like you think it will.

- Deck (aka Pitch Deck) – A 10-slide power point presentation that covers all aspects of your business in a concise and compelling way. There is a standard format and real artistry to making a good deck. Do your homework, get lots of feedback, and consider hiring a graphic designer to polish the final version.

- Exit Strategy – How you will sell the company and make your investors lots of money. Who is going to buy you and why?

Growth Hacking – A term coined by Sean Ellis to describe a marketing technique that focuses on quickly finding scalable growth through non-traditional and inexpensive tactics such as the use of social media.- Hockey Stick – The shape of the growth curve VCs want to see and believe! This means your start-up will have to double sales every year.

- IP – Intellectual Property. This can be a patent (costs $25k generally and takes time to obtain) or a secret sauce or formula like Coke. Not every start-up has IP, but if your business depends on it, you better protect it!

- Iterate – Code for try something, do it wrong, and try it again in a slightly different way with the hopes of achieving a better result.

- Pivot – Change directions as a company. This is usually used to describe going after a different market segment or using an established technology for an entirely new purpose.

- Runway – How long you have until the cash runs out and you must turn off the lights.

- Scaleable – Something that can grow to a huge size because the market and demand is big enough or because you will be able to move into different markets with your product via Pivoting or Iterating (see above).

- Term Sheet – The document that outlines what the Investors will get for what they put in — including % ownership and voting rights. If you get a term sheet, you should get excited (and get a good lawyer).

- Traction – Proof that people are actually buying and using your stuff.

- Valuation – What your company is being valued at. “Pre-money valuation” is the value before you take investors’ cash. “Post-money valuation” is that amount plus the investment put in.

- Value Prop – The feature(s) or elements that make your business or product uniquely attractive to consumers.

? “The Unicorn List“, Fortune

What is a unicorn? It’s a silly name for a privately-held company valued at $1,000,000,000 or more. The term came about because for a long while, such a company was held to be a myth—typically, companies only grew to such a size / valuation after a going public via an IPO.

The list presently contains 174 such companies. Spend some time scrolling through the list of companies, but also spend some time reading the profiles of (and maybe even doing a bit of further reading on) a few of the companies—choose a few familiar names and a few you’ve never heard of.

Non-required readings

“The beasts of Silicon Valley” by Quartz staff

Now that you know what a unicorn is in Silicon Valley parlance (and a bit about the new media / tech landscape in general), you might find this piece pretty funny. (Or not, but you’ll at least get what it’s talking about, so ¯\_(ツ)_/¯

Four Athens

Four Athens is Athens’s local technology incubator. It’s a nonprofit that connects entrepreneurs with talent, mentors, funding, and education, and they also offer co-working spaces and offices for lease. Check out their website, and maybe swing by an event—their happy hours are great (if you’re 21+, of course!).

Discussion Questions

- Has anyone you know ever worked for a startup? (Have you?) Have you ever talked to her or him about it? If so, what did s/he say? If not, go talk to them about it!

- Would you ever want to work for a startup? Why or why not?

- What changed in your notion of what a startup is as a result of reading this lesson?

- Are there any terms you learned that still confuse you? Any that you particularly liked?

Words on / reading time for this page: 1,418 words / 7-9 minutes

Words in / reading time for required readings: 7,828 words / 40-50 minutes

Total words in / reading time for this lesson: 9,246 words / 47-59 minutes

And any business, too, of course! (Heck, and for people, including you!) We’re just talking about startups at the moment.↩